The same goes for payment terms, since some charge by the hour and others by the month. Therefore, your decision will require some budgeting on your end to see what you can afford—whether it be an accounting partner or an alternative. In an effort to avoid that pitfall, many companies fall into another one. They spend hours doing tutorials, chatting with support representatives, or double-checking their numbers. And every hour spent learning or managing accounting software is an hour not spent on generating revenue directly.

- When experienced bookkeepers handle your financial tasks, they give you back valuable hours in your day to focus on core growth areas of your business.

- Our organization operates within the financial technology sector with a team of compassionate, self-caring individuals who prioritize personal growth and collective success.

- In this article, we’ll explain what exactly outsourced accounting is, what it covers, and how it can help your company.

- No matter which state you operate your business from, you’ll have to provide some sort of year-end report.

- That is, he will import all the financial information so that he can work on it on your behalf.

The complete guide to finance and accounting outsourcing services

Professional bookkeepers are well-versed in the latest legal requirements and financial trends, resulting in improved financial reporting. This is especially helpful for business owners who often take on bookkeeping themselves. Remember, the decision to outsource your bookkeeping should be strategic and align with your business goals.

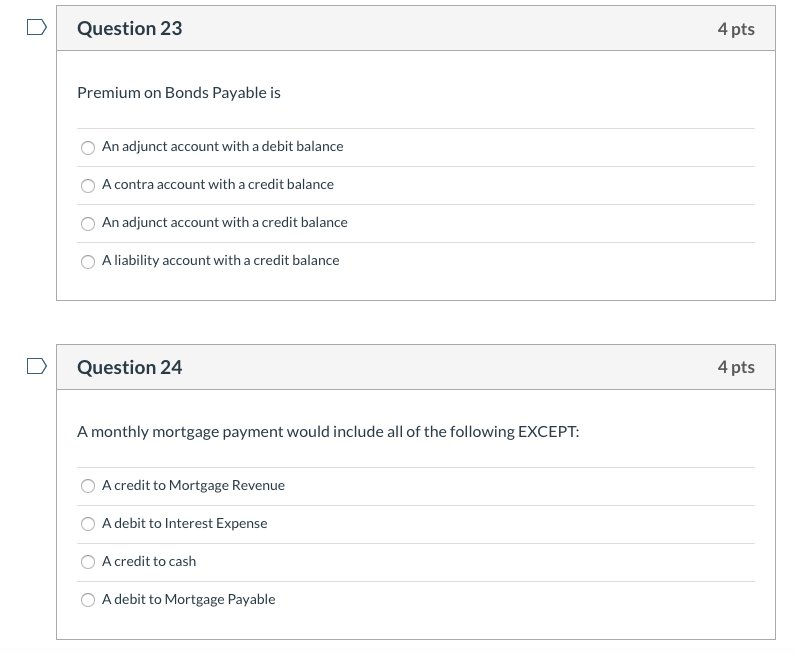

Is it cheaper to outsource accounting?

This might include a knowledge of tax strategy, insights as to how you should structure your personal compensation to be tax-efficient, and more. If you haven’t worked with an outsourcing provider before, you might have some doubts about how well this relationship will work for your business. In years gone by, it’s fair to say that the practice of outsourcing did have some negative connotations. Outsourcing is an excellent way to reduce costs and increase efficiencies but it is essential to partner with a provider that is right for your business and that starts by ticking a few key boxes. As the largest managed operations offshoring provider in the Philippines, we’ve learned a lot. Picking the right fiscal year for your business can save you and your accountant a lot of time, money and stress.

Ensure your data is protected

EAs know all of the inner tax workings of whatever state you’re operating out of, as well as what the federal government is looking for. They can help by providing tax forms like 1099s to any independent contractors https://www.business-accounting.net/noncumulative-preferred-stock-noncumulative/ you hire. Again, there is a lot of confusion around the differences between an accountant and a bookkeeper. When you throw a certified tax preparer into the mix, things can get even more muddled.

They ensure the timely collection of payments from your customers for products or services sold (AR), and management of the money you owe to vendors (AP). When hunting for bookkeeping firms, go for those who give immediate and secure access to financial reports. They should operate their business in accounting software with which you are familiar. Many business owners hire full-time in-house bookkeepers, but this isn’t the most cost-effective solution. This metric ensures that you leave every client feeling as if they’ve gotten their money’s worth. It may mean that you don’t hike your costs quite as much as you could, but a focus on long-term growth will ultimately pay off far more than a nearsighted focus on the short term.

Read on for eight of the biggest benefits of outsourcing bookkeeping and accounting. Equally, focus on finding an outsourced CFO that has significant experience navigating the challenges that are currently top of mind for your business. If your main financial goal is to sell your company, make sure you hire an outsourced CFO that has previously advised on a number of successful transactions. Firstly, establish whether the outsourced CFO you’re interested in working with has a proven track record in your industry. An outsourced CFO that’s experienced in the nonprofit sector might not grasp the financial challenges that a fast-growing technology company deals with. It’s true that many large companies outsource portions of their operations, although accounting is typically one of the areas that tends to be handled by internal teams.

This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. You can get in touch with professional bookkeepers for virtual bookkeeping through an online account. The single step vs multi step income statement virtual bookkeeper downloads your expenses through your online banking records and merchant processor, so there’s no need to send any receipt envelopes. They will deal with your financial information, bank accounts, credit cards, invoices, and other important documents.

The drawback of hiring an individual freelance bookkeeper is that they tend to be more expensive. Like an in-person, local bookkeeper, freelancers usually charge an hourly rate vs a set monthly payment. There are two primary options to outsource bookkeeping–virtual bookkeepers or local bookkeepers.

Much like outsourced bookkeeping, there are few disadvantages inherent in partnering with an outsourced controller. With the right partner, it’s possible to mitigate these downsides entirely, but to do that, you need to be aware of what to be on the lookout for. Beyond this, having a clean, organized financial infrastructure makes things significantly easier for your business come tax season.

It’s also worth mentioning that if you hope to grow or scale your business, you won’t be able to without proper bookkeeping in place. If you find yourself in a similar situation, you may be asking about how to outsourcing your bookkeeping. Get the peace of mind that comes from partnering with our experienced finance team. At Pilot, your dedicated account manager is always available to support you and answer any questions.

Their standard pay, according to Salary.com, ranges from $39,568 and $50,577 per year—before taking into account payroll taxes and employee benefits. That can be a lot if you simply need someone to perform bank reconciliations and forecasting. Full-time, in-house bookkeepers are really for businesses with advanced needs. Having professionals do your books will save you time and give you peace of mind. And the benefit of working with an online service means that you can store your data securely in the cloud, and access your financial info from anywhere, any time. When you outsource, you can leverage the expertise and experience of firms who are already established in those markets.

This makes any data forecasting talent a huge part of an accounting team’s successful performance. To keep up with the pack, we recommend brushing up on the skill with the right online courses or initiatives. Forecasting is a skill that accountants can use to predict the future. This technique depends on a knowledge of how to read historical data, which can be used to inform estimates about future trends in business expenses. Forensic accountants are the detectives of accountancy, spending their time looking into company files in search of white collar crimes like employment fraud or identity theft. These crimes are on the rise, and so forensic accountants are more likely than ever to take a look over your own company’s books.

We’ll share the types of tasks that can be outsourced and highlight the key issues business owners need to consider when assessing outsourcing accounting providers. Your expert bookkeeper will set up a digital accounting system for you if you don’t already have one. This means that we’ll take your sales and revenue data, expenses, payroll, etc, and put it all together in one financial dashboard. You’ll be able to access it anytime–desktop or mobile–and get monthly reporting with balance sheets and profit-loss statements. If you’d like to learn more, you can schedule a consultation with our team here.

When working with any service provider, it’s important to establish service-level agreements (SLAs). These lay out the specifics of the services provided and keep both parties on the same page. Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes https://www.accountingcoaching.online/ and even advise on ways to improve. You must also manage the relevant tax obligations for your employees and (in some cases) independent contractors. Again, Remote can help ensure that you are withholding (and contributing) the right amounts of tax for your employees, regardless of where they are based.